Page 100 - Annual Report

P. 100

HONG KONG ACADEMY OF MEDICINE HONG KONG ACADEMY OF MEDICINE

香 香港醫學專科學院 香 香港醫學專科學院

港

科

院

學

醫

專

學

專

學

港

醫

科

學

院

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2024 FOR THE YEAR ENDED 31 DECEMBER 2024

16. RESERVE AND FUNDS (Continued) 19. FINANCIAL INSTRUMENTS

The Academy (Continued) The Group’s major financial instruments include investments in equity instruments designated at

FVTOCI, receivables, time deposits, cash and cash equivalents and accruals and other payables.

Fair value reserve comprises the cumulative net change in the fair value of equity instruments Details of the financial instruments are disclosed in the respective notes. The risk associated with

designated at FVTOCI held at the end of the reporting period and is dealt with in accordance with the these financial instruments include credit risk, liquidity risk, currency risk, interest rate risk and price

accounting policy in note 2(h). Funds received are accounted for in the Foundation fund which is risk. The policies on how to mitigate these risks are set out below. The management manages and

used exclusively for the establishment and use of the Academy at such time as the Academy shall monitors these exposures to ensure appropriate measures are implemented on a timely and effective

direct. General fund represents the cumulative surplus of the Academy. manner.

a) Credit risk

17. CAPITAL MANAGEMENT

The Group’s credit risk is primarily attributable to receivables, time deposits and cash and cash

The Group defined all components of reserve and funds as “capital”. On this basis, the amount of equivalents. Management has a credit policy in place and the exposures to these credit risks are

capital employed at 31 December 2024 was HK$97,867,147 (2023: HK$99,384,740). monitored on an ongoing basis.

The Group’s primary objectives when managing capital are to safeguard the Group’s ability to i) In respect of the receivables, in order to minimize risk, the management has a credit

continue as a going concern. policy in place and the exposures to these credit risks are monitored on an ongoing basis.

Credit evaluations of its debtor’s financial position and condition is performed on each and

The Group’s capital structure is regularly reviewed and managed. Adjustments are made to the every major debtor periodically. These evaluations focus on the debtor’s past history of

capital structure in light of changes in economic conditions affecting the Group, to the extent that making payments when due and current ability to pay, and take into account information

these do not conflict with the Council’s fiduciary duties towards the Group or the requirements of the specific to the debtor. The Group does not require collateral in respect of its financial

Hong Kong Academy of Medicine Ordinance. assets. The Group also takes into account the economic environment in which the debtor

operates.

The Group was not subject to externally imposed capital requirements in either the current or prior

year. ii) The investments in equity instruments designated at FVTOCI are liquid securities listed on

the recognised stock exchanges. Given their high credit standing, management does not

expect any investment counterparty to fail to meet its obligations.

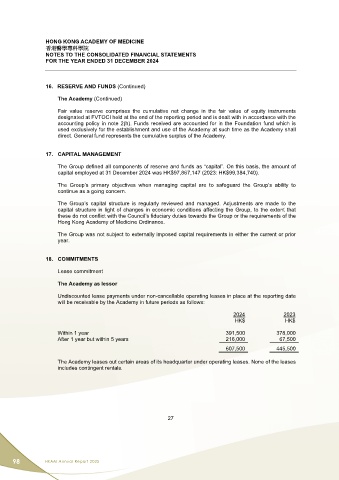

18. COMMITMENTS

iii) The credit risk on liquid funds is limited because the counterparties are banks with high

Lease commitment credit ratings assigned by international credit - rating agencies.

The Academy as lessor iv) The Group does not provide any guarantees which would expose the Group to the credit

risk.

Undiscounted lease payments under non-cancellable operating leases in place at the reporting date

will be receivable by the Academy in future periods as follows: b) Liquidity risk

2024 2023 The Group’s policy is to regularly monitor current and expected liquidity requirements to ensure

HK$ HK$ that it maintains sufficient reserves of cash and readily realisable marketable securities and/or

from other groups to meet its liquidity requirements in the short and longer term.

Within 1 year 391,500 378,000

After 1 year but within 5 years 216,000 67,500 The following liquidity tables show the remaining contractual maturities at the end of reporting

period of the Group’s non-derivative financial liabilities, which are based on contractual

607,500 445,500 undiscounted cash flows and the earliest date the Group can be required to pay.

The Academy leases out certain areas of its headquarter under operating leases. None of the leases

includes contingent rentals.

27 28

98 HKAM Annual Report 2025